How To Build A Real Estate Crowdfunding App Like Stake And Its Development Cost

Real estate investment is undeniably appealing for long-term wealth creation. However, for many, entering the world of property investment has been fraught with challenges. Traditional real estate is often characterised by inaccessibility, illiquidity, and overwhelming complexity. It's an arena where substantial capital, extensive paperwork, and a network of connections are prerequisites for participation. Great real estate deals require money, significant time, and industry knowledge.

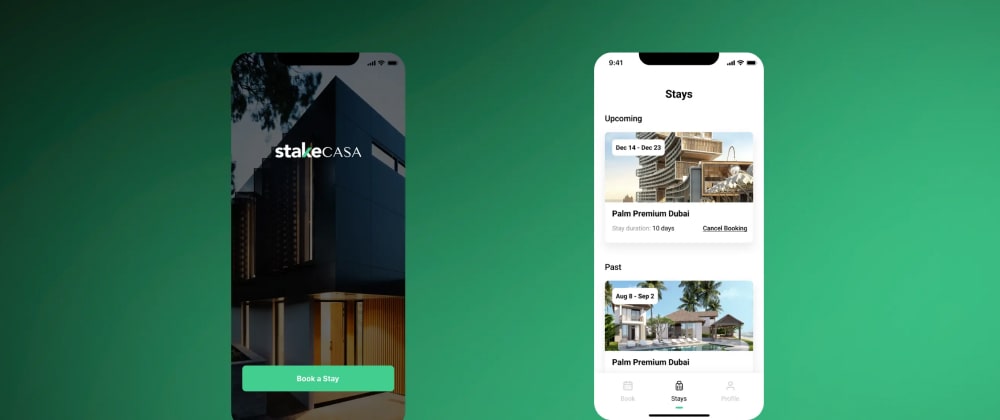

This is precisely where platforms like Stake have emerged as disruptive forces, reshaping the real estate investment landscape. Stake is a digital real estate investment platform that leverages technology and expertise to democratise property investment. Drawing upon over two decades of experience leading some of Dubai's largest real estate firms, Stake has set out to change the game's rules.

Building an app like Stake represents an enticing opportunity for entrepreneurs and innovators eyeing a venture into digital real estate investment. However, it's essential to understand how such an app works, the licensing considerations, and the associated development costs. This comprehensive guide will delve into these aspects, providing you with the insights needed to embark on a journey to create an app that revolutionises real estate investment.

What is Stake & How Does It Work?

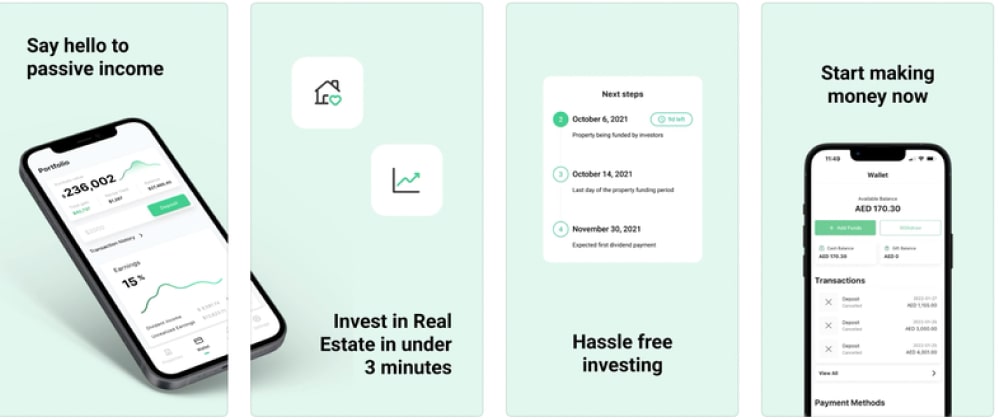

Stake is a digital real estate investment platform that aims to democratise investing by eliminating many of these formidable barriers. With Stake, the dream of building wealth through real estate is attainable and remarkably simplified, providing investors with the freedom to shape the life they deserve. Stake stands as a beacon of innovation in real estate investment.

It's more than just a digital real estate investment platform; it's a gateway to financial empowerment. It levels the playing field, making real estate investment accessible, manageable, and rewarding for everyone, regardless of their background or previous real estate experience. At its core, Stake accomplishes two fundamental objectives: it sources the best real estate properties in carefully chosen markets.

Democratising Access to Real Estate

One of the most compelling aspects of Stake is its commitment to making real estate investment accessible to virtually anyone. While traditional real estate investments often require substantial capital, Stake breaks down this entry barrier, allowing investors to begin their journey with as little as AED 500, roughly equivalent to USD 136. This affordability empowers a broader demographic of individuals to participate in real estate investing, regardless of their financial background.

Expertise and Curation

What sets Stake apart is its extensive network and expertise, built over 20+ years of leading some of Dubai's largest real estate companies. Leveraging this wealth of experience, Stake sources the best properties within its markets. This curation ensures that investors can access high-quality investment opportunities, reducing the risk associated with real estate investments.

Streamlined Management

One of the most daunting aspects of traditional real estate investment is the management of properties, from acquisition to exit. The stake takes this burden off the shoulders of investors. The platform's team manages all aspects of investments, providing a hassle-free experience for investors. From acquisition decisions to monthly rental payments and sales income, Stake handles it all, allowing investors to focus on reaping the benefits of their investments rather than getting bogged down in the complexities of property management.

Generating Passive Income

With Stake, investors can start building a diversified global real estate portfolio in minutes. By investing through the platform, individuals can generate a lifetime of passive income. This passive income stream offers the opportunity to achieve financial goals and support the lifestyle they aspire to attain.

The Rise of Digital Real Estate Investment

The appeal of real estate as an investment vehicle lies in its ability to generate consistent, long-term wealth. It's an asset class known for its resilience against market volatility, inflation hedging capabilities, and potential for steady rental income. Yet, despite these advantages, a significant portion of the population found themselves locked out of this asset class, constrained by the formidable barriers to entry.

Traditional real estate investment, especially in prime markets, often required substantial capital reserves. Down payments for properties could be excessive, making it nearly impossible for many individuals, especially those in the early stages of wealth accumulation, to participate. Additionally, the real estate market was plagued by illiquidity. Once an investment was made, it was challenging to convert it into cash swiftly. This lack of liquidity tied up capital for extended periods, limiting financial flexibility.

Moreover, real estate transactions were steeped in complexity. The abundance of paperwork, legal intricacies, and the need for local market knowledge made the process daunting for newcomers. It often necessitated the involvement of real estate agents, lawyers, and other professionals, further increasing the costs associated with property transactions.

The quest to solve these challenges birthed the digital real estate investment platform concept. These platforms, epitomised by Stake, sought to marry technology with real estate expertise to create an accessible, simplified, and liquid form of property investment. The driving force behind such platforms is the vision to open the doors of real estate wealth to a broader audience, irrespective of their financial starting point.

The success of these platforms lies in their ability to streamline the investment process, reduce entry barriers, and deliver a user-friendly experience. Investors are no longer required to navigate a maze of paperwork or commit substantial capital upfront. Instead, they can initiate their journey into real estate with minimal investment, starting as low as AED 500.

With this backdrop, we delve into the intricacies of building an app like Stake, dissecting the critical components of its functionality, regulatory requirements, and the financial considerations involved in app development. Whether you're an entrepreneur seeking to disrupt the real estate industry or an investor eager to explore new avenues, this guide will serve as your compass on this exciting journey.

Steps To Develop An App Like Stake

Market Research and Planning:

-

Identify Target Markets: Determine the regions or markets where you intend to offer real estate investment opportunities.

-

Regulatory Research: Understand each target market's legal and regulatory requirements to ensure compliance.

Property Sourcing and Selection:

-

Establish Real Estate Partnerships: Build partnerships with real estate experts and firms to source high-quality properties.

-

Property Due Diligence: Conduct thorough due diligence on properties to ensure they meet investment criteria.

Technology Infrastructure:

-

App Development: Create a user-friendly app with property browsing, investment, and portfolio management features.

-

Payment Integration: Implement secure payment gateways to facilitate investments and disbursements.

-

Security: Prioritise robust security measures to protect user data and transactions.

Regulatory Compliance:

-

Licensing: Obtain the necessary licenses and approvals to operate as a real estate investment platform.

-

Anti-Money Laundering (AML) and Know Your Customer (KYC): Implement AML and KYC procedures to verify user identities and prevent fraud.

Investment Process:

-

User Registration: Allow users to create accounts and complete KYC verification.

-

Property Selection: Enable users to browse and select properties for investment.

-

Payment Processing: Facilitate investments through secure payment methods, with a low barrier to entry.

-

Portfolio Management: Provide users with tools to monitor their real estate portfolio and track returns.

Property Management

-

Asset Management: Handle property acquisition, management, and maintenance on behalf of investors.

-

Income Distribution: Distribute rental income and sales proceeds to investors' accounts.

User Experience:

-

Mobile-Friendly Design: Ensure the app is accessible on mobile devices for user convenience.

-

Customer Support: Offer responsive customer support to address user inquiries and concerns.

Marketing and User Acquisition:

-

Marketing Strategy: Develop a marketing plan to attract investors.

-

User Education: Educate users about real estate investment and the platform's benefits.

Scaling and Growth:

-

Continuous Improvement: Regularly update the app with new features and improvements.

-

Market Expansion: Consider expanding into new markets as your user base grows.

Licensing Considerations

Licensing is critical to creating an app like Stake, as it ensures legal compliance and establishes trust with users. Licensing requirements may vary by country and region, but they often include:

-

Financial Licenses: You may need financial services and investment activities licenses depending on the jurisdiction.

-

Real Estate Licenses: In some regions, you may require licenses specific to real estate transactions and property management.

-

AML and KYC Compliance: To prevent money laundering and fraud, implement AML and KYC procedures as regulatory authorities require.

-

Securities Regulations: If your platform offers real estate investment in securities, you may need to comply with securities regulations.

-

Data Protection: Ensure compliance with data protection and privacy laws to protect user data.

-

Tax Compliance: Understand and comply with tax regulations related to real estate investments.

-

Incorporation within the DIFC: To operate within the DIFC, a company typically needs to be incorporated as a legal entity within the DIFC jurisdiction. This incorporation process involves registering the company and obtaining the necessary licenses and approvals.

Consulting with legal experts and regulatory authorities in your target markets is essential to navigate the licensing process successfully.

Development Cost of an app like Stake

Development costs to make a real estate platform app in Dubai lie between AED 80,000 to AED 120,000. We can make your app very affordable by adjusting your budget. Of course, the exact cost of development will vary depending on the features and functionalities of your app.

Several factors can influence the development cost of a real estate development app. Some of the most significant factors include the following:

Here are some of the key factors that can influence the development cost of a real estate development app:

App platform: The cost of developing a real estate app can vary based on the platform(s) it is being developed for. For example, developing an app for both iOS and Android will cost more than developing an app for just one of these platforms.

App features and functionality: The cost of developing a real estate development app will depend on the features and functionality you want to include—the more complex and extensive the features, the more required development time and cost.

User interface: Design can also affect the app's development cost. A more complex and custom user interface design will require more development time, increasing the cost.

Integration with third-party services: Third-party services such as payment gateways, mapping services, and delivery APIs can also increase the app's development cost.

App maintenance and updates: After the app is developed, ongoing maintenance and updates will also add to the overall cost. This includes bug fixes, security updates, and feature enhancements.

Team size: The size of your development team can impact the cost of developing your grocery delivery app. A larger team will require more resources and may increase the development cost.

Location: The location of your development team can also impact the cost. Development teams based in countries with lower labour costs may offer lower development costs.

Testing and Quality Assurance: Proper testing and quality assurance are crucial to ensure the smooth functioning of the app. The more thorough the testing process, the higher the development cost.

App testing: Finally, thorough app testing can add to the overall cost. Testing ensures the app functions as intended and identifies and fixes all bugs and errors.

How profitable is an app like Stake?

The profitability of an app like Stake, a digital real estate investment platform, can vary significantly depending on various factors. Here are some key considerations:

-

Business Model: The profitability of such platforms often hinges on their business model. Some platforms charge fees to investors, such as transaction or management fees, while others may take a percentage of the profits generated from investments. The choice of business model can influence revenue generation.

-

User Base: The size and engagement of the user base play a crucial role. The more investors using the platform and making investments, the higher the revenue potential. Attracting and retaining users is essential for long-term profitability.

-

Investment Volume: The total volume of investments made through the platform significantly determines profitability. Higher investment volumes can increase revenue, especially if the platform charges fees based on transaction sizes.

-

Property Performance: The performance of the real estate properties within the platform's portfolio is critical. Positive returns and rental income from properties can attract more investors and drive profitability. However, real estate markets can be cyclical, and property performance can fluctuate.

-

Platform Costs: Operating and maintaining a digital real estate investment platform incurs costs, including technology infrastructure, personnel, regulatory compliance, and marketing. Managing these costs efficiently is essential to maximising profitability.

-

Competition: The level of competition in the market can impact profitability. If the platform faces intense competition from similar services, it may need to engage in aggressive marketing or offer unique features to stand out, affecting profitability.

-

Market Conditions: Economic and market conditions can influence real estate investments. A strong economy and favourable real estate market conditions can increase investment and profitability, while economic downturns or market volatility may pose challenges.

-

Regulatory Environment: Compliance with financial regulations is essential for platforms like Stake. Regulation changes can impact operations and may necessitate costly adjustments to ensure compliance.

-

Risk Management: Effective risk management practices, including diversification of the real estate portfolio and risk assessment, are crucial. Poor risk management can lead to losses and reduced profitability.

-

Long-Term Strategy: The platform's long-term strategy and vision can also impact profitability. Expanding into new markets, introducing new features, or pursuing partnerships can open new revenue streams.

In conclusion, creating an app like Stake involves a strategic combination of real estate expertise, technology development, regulatory compliance, and user experience design. While the initial investment can be substantial, the potential to disrupt the real estate investment industry and provide accessible opportunities to investors can make it a rewarding endeavour. Careful planning, legal compliance, and a user-centric approach are essential for success in this burgeoning market.

It's important to note that the profitability of a digital real estate investment platform like Stake can take time to materialise. Building a user base, establishing trust, and achieving a critical mass of investments often require significant effort and investment upfront. Before investing in or launching such an app, conducting thorough market research and financial planning is essential to assess the potential for profitability and sustainability. Additionally, consulting with financial and legal experts with fintech and real estate expertise can provide valuable insights and guidance.

To give your innovative app idea the best chance at success, partnering with an experienced app development company is crucial. Royex Technologies is a Dubai-based mobile app development company with over 10 years of experience. Our team of developers have developed over 300 mobile apps and we are also an ISO certified company.

Royex Technologies can provide the expertise and support you need to realise your innovative app idea. For any service requirements or new development for your mobile app, call us at +971 45820203; we will be happy to help you sort it out.