How Can You Develop A Buy Now Pay Later App Like Tamara

E-commerce is on the rise in recent years. Its technology usage has exceeded levels not predicted before 2025. Buy now, pay later (BNPL) options are one of the trends fuelled by the pandemic. BNPL rescued the day when the world fell into an unparalleled economic crisis, allowing millions of people throughout the world to buy items they desperately needed in the midst of lockdowns and financial hardship.

Here in the UAE, we have seen a few BNPL making waves across the country. One such app that is widely popular is Tamara. And in this article, we will explain how you can build a “buy now pay later” app like Tamara. Let us know more about Tamara first.

What is Tamara?

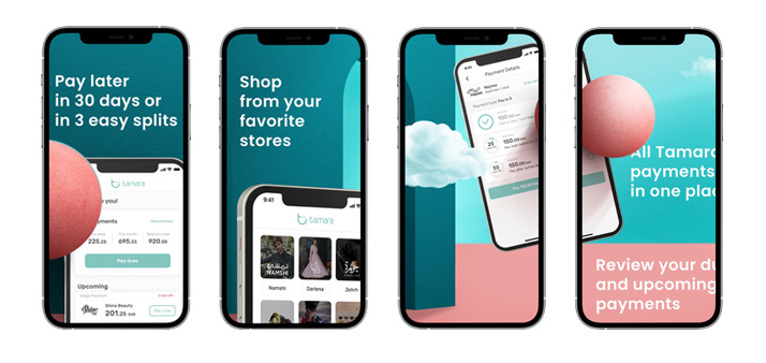

Tamra is a popular Buy Now Pay Later(BNPL) service that allows customers to either split their payments into 3 installments or pay in 30 days. Tamara is a Saudi Fintech startup with offices in KSA, UAE, Vietnam, and Germany.

Tamara received permission from the Saudi Central Bank “to test its innovative products under the Regulatory Sandbox as a first-of-its-kind in Saudi”.

Tamara’s flexible payment options can be enjoyed at over 100 partnered stores featuring well-known brands such as Shein, Namshi, IKEA, The Luxury Closet, Elite Shoe, Godiva, OB, Rabea, Qeta, among others.

Tamara allows both online and in-store purchases via their mobile app. There are no additional fees, interest, or hidden charges for using the app. All you need to do is provide your ID and mobile number, and choose Tamara during the checkout process.

You can pay with Mastercard, Visa, or even ApplePay. Tamara makes money from the commission they charge from the stores that are registered with them and take nothing from the customers directly.

To use Tamara, you need to be a citizen of either Saudi Arabia or the United Arab Emirates and be 18 years of age. Tamara is completely Sharia law compliant and is reviewed and certified by the Shariah review bureau.

To become Tamara’s partner is quite easy too. You need to sign up for your store with Tamara, integrate Tamara via API or plug-in, and accept either split payments or payment in 30 days from customers.

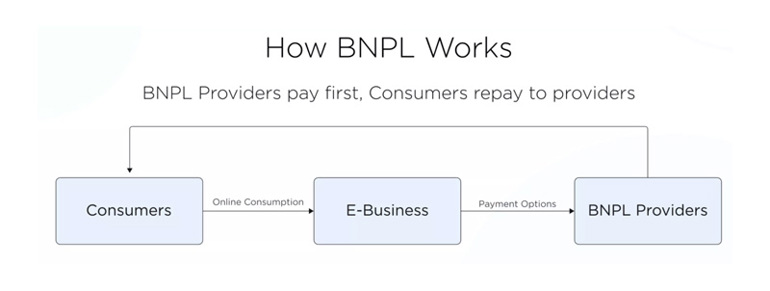

How do BNPL work and its current state

In its most basic form, the Buy Now Pay Later service is comparable to using a credit card or taking out a soft loan. Pay later purchasing allows you to purchase items online and pay for them over a certain length of time, such as a few months.

Customers make online purchases without paying the bill at checkout, making this a more convenient pay later purchasing approach. Customers may acquire a loan fast and simply because the process has been greatly simplified. To prevent late payment fines and a negative impact on your credit score, the loan should be paid back on time.

Because of the financial problems caused by COVID-19, today's customers are searching for flexible financing solutions, notably interest-free ones. BNPL is the preferred option for many.

Online sales surged by 16 percent during the early stages of the pandemic. However, over the same time period, internet fraud instances increased by 30%. With the rise in fraud, governments throughout the world have put in place stringent cyber safeguards to guarantee that e-commerce platforms and BNPL service providers follow the law to the letter.

Here are some statistics indicating the rise in the demand for BNPL services:

- The number of BNPL applications downloaded increased by 162 percent from 2018 to 2019.

- It increased by 134 percent in the second quarter of 2019

- Sales with BNPL increased by 215 percent in just two months of 2020

- It had a volume of US $6990.5 million by the end of 2020

- The increase is expected to be 24.2 percent between 2021 and 2028

- According to projections, it will reach $52827.2 million in the United States by 2028.

Revenue Model of a BNLP app like Tamara

Buy Now Pay Later Apps like Tamara don’t charge directly from the customers. Instead, they make their money from the brands that they are partnered with. Here are the various ways these apps earn their revenue:

Initial setup fee: Charge brands an initial fee to partner with them. Although Tamara doesn’t charge this from their partners, other similar apps are doing so.

Monthly fee: Charge a monthly fee from brands to give them certain perks and incentives giving them an edge over other brands. A win-win situation for both.

Late fee: The only instance when apps like Tamara can charge customers is when they are late on their scheduled payment. In this case, the app can impose a penalty fee on the customer. Tamara charges, 25 SAR, 25 AED, and 2KWD as late fees in Saudi Arabia, UAE, and Kuwait respectively.

Transaction fee: This is where Tamara makes the bulk of its revenue. For every sale through their app or payment option, Tamara receives a commission that is charged from the merchant.

What are the benefits of integrating a BNPL app for Ecommerce owners?

Many ecommerce stores are now allowing one or more options of a buy now pay later service to their customers as the benefits are evident to them. So what benefits can they get from integrating a service like Tamara with their online store?

Increased transaction value

Customers are happy to pay one-third or one-fourth of the price of a product and pay the rest in installments with zero interest or fees thus increasing the transactions of the store.

Repeat purchases

The user-friendly experience and the benefits provided ensure that purchases will be made again and again. Consistent revenue and repeat consumers go hand in hand.

Higher conversion rates

The option to pay partially will lead to increased impulse purchases and that will ultimately result in higher conversion rates.

Bigger customer base

Paying in installments without interest will attract more customers to your store naturally. It is one of the best ways to grow your business.

Security features needed in a BNPL app like Tamara

A buy now pay later app like Tamara needs all kinds of security to ensure customer data protection and information encryption. Here are the different security features required in an app like Tamara:

Integrate security

The developers should create multiple security layers at each stage of development to protect the app's data from any attacks. There shouldn't be even a bit of sensitive data access.

Data encryption

To decrease the danger of a cyberattack in the internet ecosystem, all data is encrypted. The app has to be equipped with solid encryption mechanisms to protect it. Encryption is used for all data handling and processing.

Two-Factor Authentication

This is a common feature used by most app developers nowadays. It ensures double the security for your app.

Regulation compliance

Because of the growth in online fraud, you need to ensure that the data collecting and information handling methods adhere to strict standards such as PCI DSS and others.

App + Web Bundle for Maximum Reach

Don’t just stop at mobile—adding a companion web portal extends your customer base, enhances credibility, and supports omnichannel engagement. As a leading Mobile apps development company in Dubai, Royex builds seamless cross-platform solutions.

Need a robust web platform as well? Our expert Website Designing company Dubai team crafts responsive, conversion-first portals for your users.

Advanced Features to Elevate Your BNPL App

Pursue excellence by including these value-driving features:

-

Smart Credit Scoring & Risk Engine – AI/ML-powered real-time assessment

-

Instant KYC & AML Authorization – OCR + biometric onboarding

-

EYAANA Chat & Voice Support – Always-on conversational support powered by AI

-

Flexible Installment Plans – Tailored durations and partial payments

-

Push Notifications & Smart Reminders – Timely nudges before due dates

-

Merchant Dashboard – Vendors view conversions, redemptions, and analytics

-

Referral Rewards & Loyalty Incentives – Incentivize both users and merchants

-

Multi-Currency & Multi-Language – Essential for GCC-wide adoption

These features not only improve user trust but also drive higher retention and merchant uptake.

UAE-Specific Compliance & Integrations

To thrive in Dubai and the UAE market, your BNPL platform should include:

-

Integration with UAE Payment Gateways: Network Int’l, Telr, Mashreq

-

Bilingual UI & RTL Layout: Arabic + English support is critical

-

Regulatory KYC/AML Compliance: Emirates ID, UAE Pass, Federal regulations

-

Secure Digital Wallet + Escrow Mechanisms: Bank-level encryption

Royex supports full local compliance and integration from day one.

Estimated Cost & Development Timeline

| Module | Estimated Cost (AED) | Development Time |

|---|---|---|

| Core BNPL App (iOS/Android + Backend) | 60K – 90K | 10–14 weeks |

| AI Credit Engine + KYC Integration | +15K – 20K | +2–3 weeks |

| Merchant Dashboard | +15K – 20K | +2–3 weeks |

| Companion Website + Admin Panel | +15K – 25K | +3–4 weeks |

Total Budget Range: AED 60K to 120K

Post-launch support & hosting can be added separately.

Frequently Asked Questions (FAQs)

Q1. How much does it cost to build a BNPL app like Tamara in Dubai?

A basic BNPL platform starts at AED 150K–250K, covering iOS/Android and backend. With AI credit scoring, merchant dashboards, and a web portal, total investment ranges from AED 250K–400K.

Q2. Can I launch both an app and a website simultaneously?

Absolutely! Royex is a premier Mobile apps development company in Dubai and also a trusted Website Designing company Dubai—we deliver integrated solutions for both web and mobile.

Q3. Do you support UAE compliance like KYC and AML?

Yes—Royex ensures full compliance, integrating Emirates ID authentication, biometric checks, and AML/KYC workflows tailored to UAE federal regulations.

Q4. How long does development typically take?

A full-feature app plus web portal generally takes 4–6 months, covering planning, development, testing, and launch across platforms.

Q5. What ongoing support is provided post-launch?

Royex offers annual support packages including app maintenance, AI model updates, compliance reviews, hosting, and performance optimization.

Why Royex Technologies?

Royex Technologies is a leading mobile app development company in Dubai. We have successfully delivered more than 300 projects to date for our clients around the world. Each day, we’re adding new feathers to our cap. Our sole aim is to provide high-quality mobile apps for our clients.

You can check our website and have a look at the portfolio for reassurance. Our committed and dedicated teams work relentlessly to uphold the fame we’ve achieved for the last few years. You can rely on us with the responsibility of making your dreams turn into reality. Let us know what you’re expecting from the app, we’ll do the rest. Email us at info@royex.net or call on +971566027916.