How Can You Develop A Buy Now Pay Later App Like Tabby

When you reach the checkout page after an online buying binge, you've undoubtedly heard the phrases "buy now, pay later" (BNPL) or seen a BNPL option. In the past year, BNPL services, which are basically point-of-sale loans, have acquired a lot of popularity, with big names like Amazon collaborating with a prominent BNPL provider and Mastercard announcing the launch of its own BNPL service.

Now, the craze has shifted to the MENA region, and here in the UAE, the BNPL is trending all over. One popular “buy now pay later” service used in the UAE is Tabby.

In this article, we will take a look at Tabby, its services and features, and how you can develop an app like Tabby.

What is Tabby?

Tabby allows customers to get their preferred goods delivered to their homes without having to pay the whole price right away. Customers can pay in installments and pay for their purchases in full according to a predetermined schedule.

Many merchant sites and individuals have begun to use the app since it enables safer payment mechanisms without the hassles of transaction delays and fund processing.

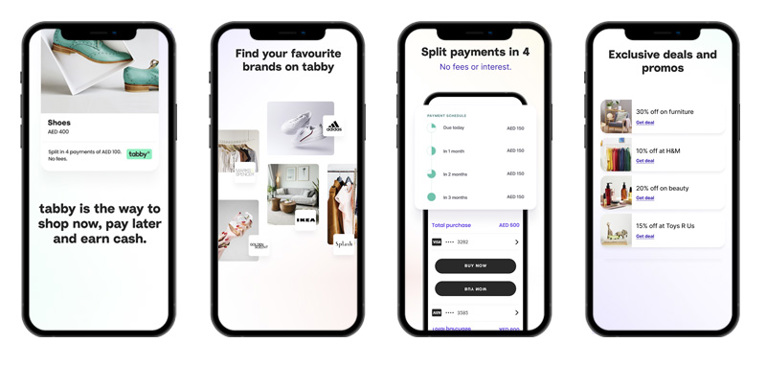

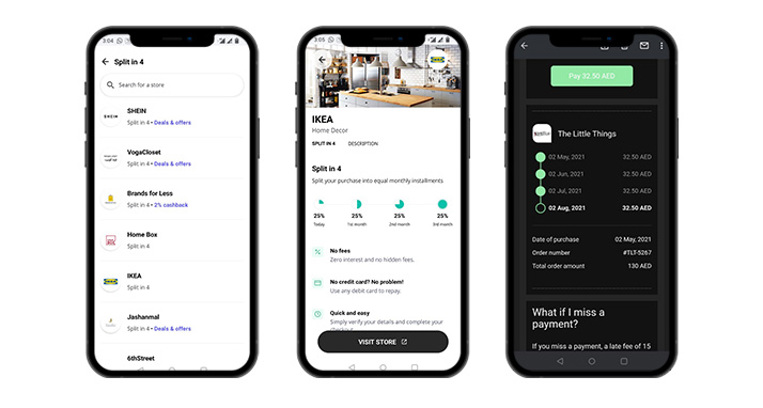

Tabby allows you to divide your purchases into four interest-free installments or pay after 14 days. These two forms of payment offer customers convenience and flexibility without any additional fees.

Tabby accepts any debit or credit card and you can get instant approval. Tabby has partnered with popular stores here in the UAE such as IKEA, H&M, Namshi, Shein, AliExpress, BabyShop, GAP, Home Centre, Lacoste, Nike, Sephora, Carrefour, and many other popular brands.

You can shop with these brands online and choose Tabby at checkout, or shop in-store, and scan the tabby QR code when you’re at the store. Then you can choose any of the two payment methods; either pay in 14 days, or pay 25% upfront, and pay the rest monthly over the next three months.

In case, a customer misses a payment, a late fee of 15 AED is charged a day after a payment is due. If they have not repaid for another two weeks, an additional late fee of 30 AED is applied.

Tabby doesn’t charge any fees or interest from the shoppers, as stated above. The way Tabby makes money is by charging retailers for using their service. This is the basic premise of Tabby.

How Does The Tabby App Work?

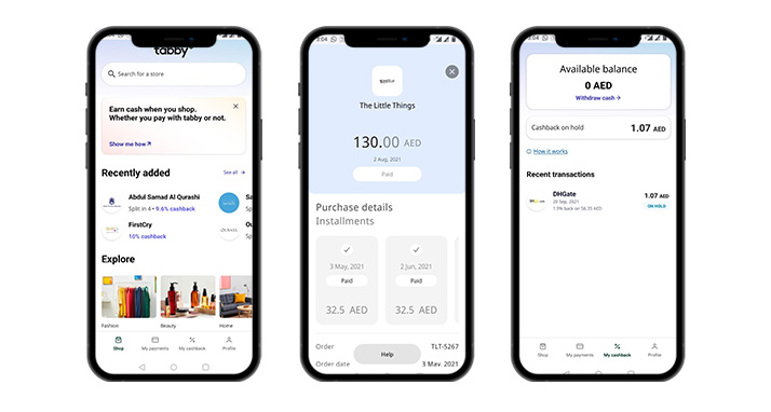

Customers can enjoy shopping with Tabby by first installing the app. The complete process is described below:

Step 1: The consumer registers in the app to create an account and verify their identity by providing their Emirates ID.

Step 2: After the approval procedure, the client can purchase an item and choose Tabby during the checkout process.

Step 3: The customer must then choose between the two options; pay in 14 days or pay in 4 installments.

Step 4: After charging a commission from the merchant, Tabby pays the merchant the entire money right away.

Step 5: After all of the procedures are fulfilled, the consumer begins paying the agreed-upon amount to Tabby on a monthly basis.

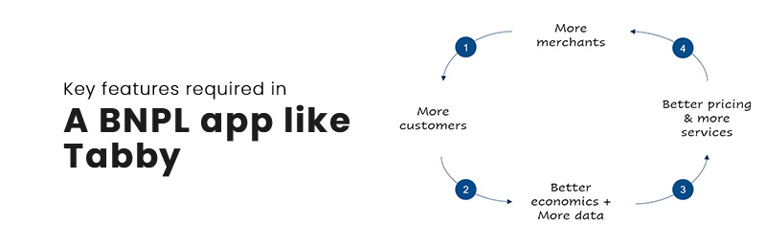

Key features required in a BNPL app like Tabby

If you want an app like Tabby developed, you need to provide some basic and some advanced features like the ones available in Tabby. We will discuss those features in this section.

Login and verification: By integrating the app with their phone number, the user will register themselves with the app. After that, they have to provide their national identification number to complete the verification process.

Account management: Display all the account information of the customer including their purchase history, upcoming payment dates, and other relevant information of the customer.

Reminders: Customers will be informed of their impending payment amounts and due dates, allowing them to make timely payments and prevent overdrafts.

Automatic deductions: Allow your clients to manually enable this functionality, which will allow the app to take costs from the selected card automatically. They should also be able to add multiple cards and switch them when needed.

Advanced payment: Customers can pay in installments even if the due date is not yet reached.

Featured stores: An separate section in the app to highlight the best brands with which the app has collaborated, so clients don't have to dig around to find out which companies support the payment service.

Guest feature: Customers without an account can still use the app and sign up later while making payments.

Cashback: Offer a percentage-based cashback from selected stores to customers when using the app to shop.

Security: With the most strong and effective security system in place, the app is protected from cyber-attacks and data loss.

Factors That Affect the Development Cost of an App Like Tabby

App Platform

Different platforms have varying degrees of complexity. Some require more written codes, while others may get by with only a few. Furthermore, you must test the app on a variety of devices, and the hybrid and native platforms are continually at odds. As a result, the cost of development is influenced by the type of app development platform used.

App Design

An app should be built in such a way that users find it simple and straightforward to use, with no bugs or problems. The development cost will be higher if you can invest more in modern technology to create high-end designs.

App Development Team

To produce an app like Tabby with outstanding features, designs, and functionality, you'll need to hire a highly trained experienced team of mobile app developers. Inexperienced developers are more prone to make a mistake while creating such complex mobile apps. Naturally, the cost of developing a mobile app will be more if you choose a skilled developer with a lot of expertise. We can assist you to a great degree if you are seeking skilled mobile app developers in Dubai.

App feature and functionality

Tabby comes with a plethora of features. You don't have to supply all of the features when you're just starting out. Choose just the functions that are necessary and spend money on making them helpful to the users. The more features you include, the more expensive it is to create an app like Tabby. At first, we recommend focusing on fewer features. Once you've established a following, you may add new features and functions.

Cost to Develop an App Like Tabby

The development cost of a buy-now-pay-later like Tabby will cost you from AED 60000 to AED 80000. This is just a ballpark figure. We can predict the cost more precisely if you provide us with detailed descriptions of the app, mentioning your requirements and expectations. You can contact us for more details.

We can also help you integrate a buy-now-pay-later app like Tabby in your mobile app or ecommerce website.

Email us at info@royex.net or call on +971566027916. Here at Royex, we have an experienced developer team who have hands-on experience in making user-friendly, beautiful, functional, and bug-free mobile apps across all platforms.

Expand to App + Web Ecosystem

A BNPL app doesn’t have to stand alone; you can pair it with a responsive web portal to boost visibility, improve UX, and enhance adoption.

As a trusted Mobile apps development company in Dubai, Royex can build seamless mobile and web ecosystems that allow users to manage payments, view transaction history, and adjust financing terms—anywhere, anytime.

Looking to launch a desktop version? Our team at the Website Designing company Dubai crafts sites optimized for speed, conversion, and SEO.

Key Features to Elevate Your BNPL Platform

Going beyond basics, consider adding these advanced capabilities:

-

Dynamic Credit Scoring – AI/ML-driven risk assessment in real-time

-

Instant In-App Onboarding – AML/KYC checks via OCR and facial recognition

-

AI Chat & Voice Support – Powered by EYAANA for tracking payments or asking about terms

-

Smart Notifications – Push or email reminders before due dates and special offers

-

Merchant Dashboard – Vendors can view conversions, refunds, and usage analytics

-

Referral & Rewards System – Encourage word-of-mouth with incentives for users and merchants

-

Multi-Currency & Multilingual Support – UAE AED support, Arabic + English interface with RTL

These features enhance user trust, engagement, and platform credibility.

Cost & Timeline Overview

| Component | Estimated Cost (AED) | Timeline |

|---|---|---|

| Core BNPL App (iOS/Android) + Backend | 150K – 250K | 16–20 weeks |

| AI Credit & Risk Module + KYC Integration | +50K – 80K | +4–6 weeks |

| Merchant Dashboard & Reporting Panel | +40K – 70K | +3–5 weeks |

| Companion Website for User & Merchant Access | +30K – 50K | +4–6 weeks |

| Post-launch Support + Payments/Security Audit | AED 40K/year | Ongoing |

We're also happy to bundle maintenance, PCI compliance, fraud monitoring, and marketing plugins for you.

UAE Market-Specific Integrations

To compete effectively in Dubai, your BNPL platform must include:

-

Connect with UAE Payment Gateways: Network International, Telr, Mashreq

-

Arabic–English bilingual UI with RTL support

-

Compliance with UAECentral bank regulations + data locality laws

-

Analytics dashboards tailored for merchants, reflecting local sales cycles

At Royex, we bring deep knowledge and local integrations to deliver compliant, high-performing BNPL solutions.

Frequently Asked Questions (FAQs)

1. How much does it cost to develop a BNPL app in Dubai?

Expect a base range of AED 150K–250K for mobile apps with backend infrastructure. Full-featured platforms—including AI credit scoring, merchant dashboards, and web portals—can range up to AED 300K–450K.

2. Can a companion website be built alongside the app?

Yes. Along with being a top Mobile apps development company in Dubai, Royex offers web portal development through our Website Designing company Dubai. This allows full access for users and merchants from any device.

3. What kind of features are essential for compliance?

You’ll need:

-

KYC/AML verification (using OCR and government APIs)

-

Audit-trail for transactions

-

Secure data encryption and PCI-DSS compliance

-

Customer consent flows and legal disclosures

Royex ensures all features meet both UAE and global compliance standards.

4. How long does development take?

From kickoff to launch, expect 4–6 months depending on the complexity (credit scoring, merchant modules, real-time risk checks).

5. Why choose Royex for this project?

With 500+ projects across fintech and e-commerce, Royex is a top Mobile apps development company in Dubai. We combine deep UAE market knowledge, compliance experience, and UX expertise. Plus, we offer full web + mobile builds through our Website Designing company Dubai.

Why Royex Technologies?

Royex Technologies is a leading mobile app development company in Dubai. We have successfully delivered more than 300 projects to date for our clients around the world. Each day, we’re adding new feathers to our cap. Our sole aim is to provide high-quality mobile apps for our clients.

You can check our website and have a look at the portfolio for reassurance. Our committed and dedicated teams work relentlessly to uphold the fame we’ve achieved for the last few years. You can rely on us with the responsibility of making your dreams turn into reality. Let us know what you’re expecting from the app, we’ll do the rest.